Embarking on a journey can be filled with excitement and anticipation, but it’s crucial to ensure you’re adequately prepared for any unforeseen circumstances. This is where airline travel insurance comes into play, offering peace of mind and protection for travelers against various risks during their trips.

Let’s delve into the world of airline travel insurance to understand its significance and benefits.

Importance of Airline Travel Insurance

When planning a trip, one of the essential things to consider is purchasing airline travel insurance. This type of insurance provides a safety net for travelers in case unexpected situations arise during their journey.

Benefits of Having Airline Travel Insurance

- Medical Emergencies: Airline travel insurance can cover medical expenses if you fall ill or get injured during your trip.

- Trip Cancellation: In the event of unforeseen circumstances leading to the cancellation of your trip, airline travel insurance can help recover non-refundable expenses.

- Lost Luggage: If your luggage goes missing or gets damaged, airline travel insurance can provide compensation for the lost items.

- Flight Delays: Insurance can help cover additional expenses incurred due to flight delays, such as accommodation and meals.

Examples of Situations Where Airline Travel Insurance Can Be Helpful

- Imagine you suddenly fall ill during your trip and require medical attention. Without insurance, you could face hefty medical bills.

- If your flight gets canceled due to bad weather, having airline travel insurance can help you recoup the costs of your unused ticket.

- In the unfortunate event that your luggage is lost or stolen, insurance can provide reimbursement for your belongings.

Coverage Types

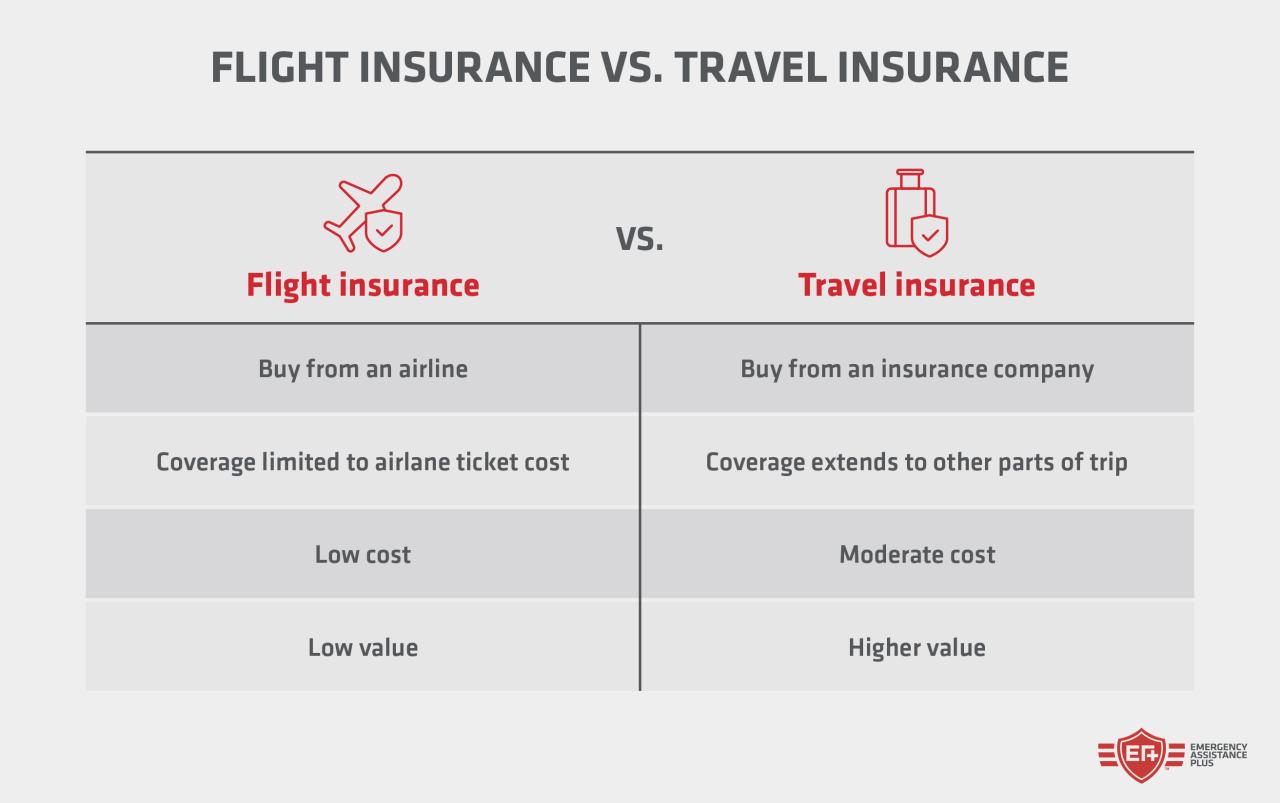

When it comes to airline travel insurance, there are different types of coverage offered to travelers depending on their needs and preferences. Let’s take a closer look at the basic coverage versus premium coverage options, as well as specific inclusions and exclusions in airline travel insurance policies.

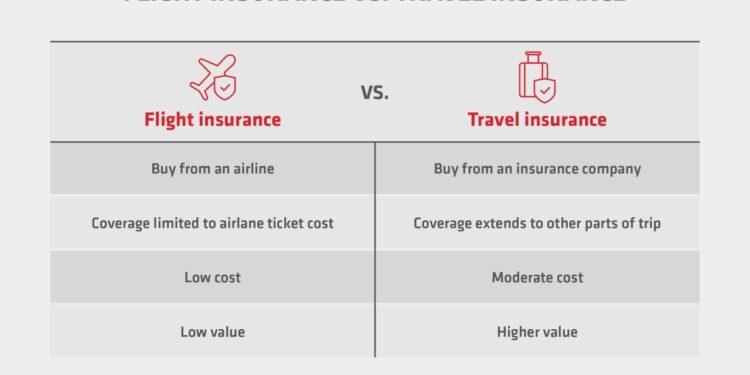

Basic Coverage vs Premium Coverage

- Basic Coverage: This typically includes trip cancellation, trip interruption, baggage loss, and emergency medical coverage. It provides essential protection for common travel-related issues.

- Premium Coverage: Premium options may offer higher coverage limits, additional benefits such as rental car protection, concierge services, and coverage for adventure activities. Premium coverage is suitable for travelers seeking comprehensive protection and added peace of mind.

Inclusions and Exclusions

- Inclusions: Airline travel insurance policies usually cover trip cancellations due to unforeseen events like illness, natural disasters, or airline strikes. They also provide coverage for emergency medical expenses, baggage loss, and travel delays.

- Exclusions: Common exclusions in airline travel insurance include pre-existing medical conditions, travel to high-risk countries, extreme sports activities, and losses due to reckless behavior or illegal activities. It’s essential to review the policy details carefully to understand what is covered and what is not.

Cost Factors

When it comes to airline travel insurance, the cost can vary depending on several factors. Understanding these cost factors can help travelers make informed decisions when choosing a policy.

Trip Duration, Destination, Age, and Coverage Level

- The trip duration plays a significant role in determining the cost of airline travel insurance. Longer trips may require higher coverage limits, leading to increased premiums.

- The destination also impacts the cost, with some countries having higher healthcare or emergency assistance costs, resulting in higher insurance premiums.

- The age of the traveler is another crucial factor. Older travelers may face higher premiums due to increased health risks and potential medical expenses.

- The coverage level chosen by the traveler directly affects the cost of airline travel insurance. Comprehensive coverage with added benefits will naturally come at a higher price.

To find affordable yet comprehensive airline travel insurance, travelers can consider the following tips:

- Compare quotes from multiple insurance providers to find the best value for money.

- Opt for a policy tailored to your specific travel needs to avoid paying for unnecessary coverage.

- Consider purchasing insurance as soon as you book your trip to take advantage of early bird discounts.

- Check if your credit card offers any travel insurance benefits to potentially save on additional costs.

Claim Process

When it comes to filing a claim with airline travel insurance, there are specific steps that need to be followed. It’s essential to understand the process to ensure a smooth and successful claim experience.

Steps Involved in Filing a Claim:

- Notify the insurance provider: Contact your insurance provider as soon as possible after the incident occurs to start the claims process.

- Complete claim forms: You will need to fill out claim forms provided by the insurance company. Make sure to provide accurate and detailed information.

- Submit required documentation: Along with the claim forms, you will need to submit relevant documentation to support your claim, such as medical reports, receipts, and proof of travel.

- Wait for claim assessment: The insurance company will assess your claim based on the information and documentation provided. This process may take some time.

- Receive reimbursement: If your claim is approved, you will receive reimbursement for the covered expenses as per your policy.

Documentation Required for Making a Claim:

- Proof of travel: This includes your airline tickets, boarding passes, and itinerary.

- Medical reports: If your claim is related to a medical emergency, you will need to provide medical reports from a licensed healthcare provider.

- Receipts: Keep all receipts related to your claim, such as medical bills, hotel expenses, and transportation costs.

- Police reports: In case of theft or loss, a police report may be required to support your claim.

Tips to Expedite the Claim Process:

- Submit all required documentation promptly to avoid delays in processing your claim.

- Double-check all forms and information to ensure accuracy and completeness.

- Keep copies of all documents submitted for your records.

- Follow up with the insurance provider if you do not receive updates on your claim status.

Last Point

In conclusion, airline travel insurance serves as a safety net for travelers, providing financial protection and assistance in times of need. By understanding the coverage types, cost factors, and claim process, individuals can make informed decisions to safeguard their travel experiences.

Whether it’s a short weekend getaway or a long international voyage, having airline travel insurance can make all the difference in ensuring a smooth and worry-free journey.

FAQ Explained

What does airline travel insurance cover?

Airline travel insurance typically covers trip cancellations, delays, lost baggage, medical emergencies, and other unforeseen events during your journey.

How much does airline travel insurance cost?

The cost of airline travel insurance depends on factors like trip duration, destination, age of the traveler, and the level of coverage chosen. It can range from a few dollars to a percentage of the total trip cost.

Can I purchase airline travel insurance after booking my flight?

Yes, you can usually purchase airline travel insurance even after booking your flight, but it’s recommended to buy it as early as possible to benefit from full coverage options.

Are pre-existing medical conditions covered by airline travel insurance?

Most airline travel insurance policies do not cover pre-existing medical conditions unless specified in the policy. It’s important to review the terms and conditions carefully.