Diving into the realm of covermore travel insurance for seniors, this introduction sets the stage for an informative journey. With a mix of engaging language and detailed insights, readers are drawn in from the get-go.

The following paragraph will delve into the specifics of the topic, providing a comprehensive overview.

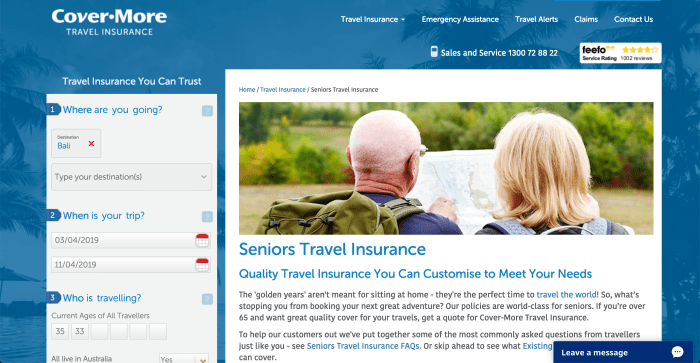

Overview of Covermore Travel Insurance for Seniors

Covermore travel insurance for seniors provides comprehensive coverage for older travelers, ensuring peace of mind during their trips.

Key Features and Benefits

- Emergency medical coverage for unexpected illnesses or injuries during travel.

- Coverage for trip cancellation or interruption due to unforeseen circumstances.

- Baggage loss or delay coverage to protect belongings while traveling.

- 24/7 emergency assistance services for any travel-related emergencies.

Age Limits and Eligibility Criteria

Seniors aged 65 and above are eligible for Covermore travel insurance. Some plans may have higher age limits up to 85 years. To qualify, seniors must be fit to travel and not have any pre-existing medical conditions that are excluded from coverage.

Types of Coverage Included

- Medical expenses for doctor visits, hospital stays, and prescription medications.

- Emergency medical evacuation to transport seniors to the nearest adequate medical facility.

- Coverage for trip delays, missed connections, or lost travel documents.

- Optional add-ons for adventure activities, pre-existing conditions, and rental car coverage.

Importance of Travel Insurance for Seniors

Travel insurance is crucial for senior travelers as it provides peace of mind and financial protection during their trips. Seniors may face increased health risks while traveling, making it essential to have coverage in case of unexpected medical emergencies or accidents abroad.

Without travel insurance, seniors could be at risk of incurring high medical expenses or facing other unforeseen costs that could disrupt their travel plans and financial security.

Financial Protection

Travel insurance can offer financial protection to seniors by covering expenses such as emergency medical treatment, hospital stays, medical evacuation, trip cancellations, lost luggage, and other unforeseen circumstances. Having travel insurance ensures that seniors are not burdened with hefty bills or unexpected costs that could arise during their travels.

Peace of Mind

Having travel insurance gives seniors peace of mind knowing that they are protected in case of emergencies. Seniors can relax and enjoy their trip without worrying about the financial implications of any unforeseen events that may occur during their travels.

This peace of mind allows seniors to fully immerse themselves in their travel experiences and make the most of their trips.

Benefits of Travel Insurance vs. Traveling Without Insurance

- Travel insurance provides coverage for medical emergencies, trip cancellations, lost baggage, and other unforeseen events, while traveling without insurance leaves seniors vulnerable to unexpected costs and disruptions.

- With travel insurance, seniors have access to 24/7 emergency assistance services that can help them navigate any medical or travel-related emergencies, providing support and guidance when needed.

- Travel insurance offers a safety net for seniors, protecting them from financial risks and ensuring that they can travel with confidence and security.

Specific Coverage Details

Travel insurance for seniors provided by Covermore offers a range of coverage options to ensure peace of mind during their trips.

Medical Coverage

- Coverage for emergency medical expenses, including hospital stays, surgeries, and ambulance services.

- Reimbursement for prescribed medications and medical treatments required during the trip.

- 24/7 access to a helpline for medical assistance and guidance in case of emergencies.

Trip Cancellations, Delays, and Interruptions

- Reimbursement for non-refundable trip expenses in case of trip cancellations due to unforeseen circumstances.

- Coverage for additional accommodation and meals in case of trip delays caused by factors outside the traveler’s control.

- Compensation for missed connecting flights or alternate transportation arrangements in case of trip interruptions.

Additional Coverage Options

- Optional coverage for pre-existing medical conditions, ensuring seniors with health concerns are adequately protected.

- Coverage for high-value items such as jewelry, electronics, or cameras to safeguard valuable possessions during the trip.

- Additional coverage for adventurous activities like skiing, scuba diving, or hiking, catering to seniors with active lifestyles.

Claim Process and Customer Support

When it comes to filing a claim with Covermore travel insurance for seniors, the process is straightforward and designed to provide assistance when needed. The customer support options available for seniors needing help while traveling ensure that they can easily access the help they require.

Filing a Claim with Covermore Travel Insurance

- Notify Covermore as soon as possible: In case of an emergency or unexpected event, seniors should contact Covermore immediately to report the incident.

- Submit necessary documentation: Seniors will need to provide all required documents to support their claim, such as medical reports, police reports, or receipts.

- Wait for claim assessment: Once all documentation is submitted, Covermore will assess the claim and inform seniors of the outcome.

- Receive payment or assistance: If the claim is approved, seniors will receive payment or assistance as per the terms of their policy.

Customer Support for Seniors

- 24/7 Emergency Assistance: Seniors can access Covermore’s emergency assistance line anytime, anywhere for immediate help.

- Dedicated Customer Service: Covermore has a team of customer service representatives trained to assist seniors with any questions or concerns they may have.

- Online Support: Seniors can also use Covermore’s online platform to access policy information, file claims, or get in touch with customer support.

Real-life Experiences

“My husband fell ill during our trip, and we had to seek medical help. Covermore was quick to assist us with the claim process, and we received reimbursement for all medical expenses incurred. Their customer support was also very helpful and reassuring throughout the entire ordeal.”Mrs. Smith

“I lost my luggage during a layover, and I was worried about the cost of replacing all my belongings. Covermore’s customer support guided me through the claim process, and I was able to receive compensation for the lost items. It was a relief to have their support during a stressful situation.”Mr. Johnson

Conclusion

Concluding our discussion on covermore travel insurance for seniors, this final paragraph encapsulates the key points and leaves readers with a lasting impression.

FAQs

What age limits are there for seniors to qualify for Covermore travel insurance?

Seniors typically need to be between the ages of 60-89 to qualify for Covermore travel insurance.

What does the medical coverage for seniors include in Covermore travel insurance?

The medical coverage often includes emergency medical expenses, hospital stays, and medical evacuation for seniors.

How can seniors file a claim with Covermore travel insurance?

Seniors can file a claim by contacting the Covermore customer support team and following the Artikeld steps for claims submission.