Embark on a journey through the world of extended travel insurance, where peace of mind meets practicality. Discover how this type of insurance can enhance your travel experience in unexpected ways.

Delve into the details of coverage, benefits, and considerations surrounding extended travel insurance to make informed decisions for your next adventure.

Definition and Importance of Extended Travel Insurance

Extended travel insurance refers to a type of insurance coverage that is specifically designed for long trips, typically lasting more than 30 days. It offers additional protection and benefits beyond what standard travel insurance policies provide.

Importance of Extended Travel Insurance

Extended travel insurance is crucial for long trips due to the following reasons:

- Extended medical coverage: Standard travel insurance may have limitations on the duration of coverage for medical emergencies. Extended travel insurance ensures that you are protected for the entire duration of your trip, reducing the risk of unexpected medical expenses.

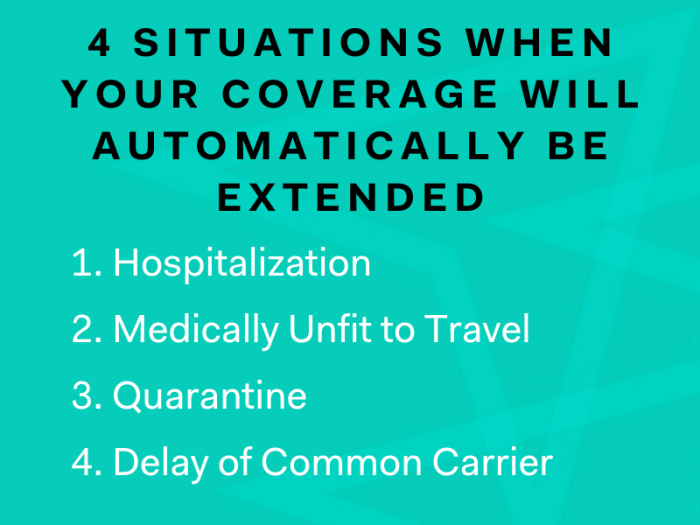

- Trip interruption coverage: Long trips are more susceptible to unforeseen events that may disrupt your travel plans. Extended travel insurance can cover additional expenses incurred due to trip interruptions, such as accommodation and transportation costs.

- Emergency evacuation coverage: In the event of a medical emergency or a natural disaster, extended travel insurance can provide coverage for emergency evacuation to a medical facility or back to your home country.

Coverage Details

Extended travel insurance offers a wide range of coverage to travelers, providing additional protection beyond what regular travel insurance typically offers. Let’s delve into the specific coverage details provided by extended travel insurance and compare it with regular travel insurance.

Medical Coverage

Extended travel insurance often includes higher limits for medical expenses coverage compared to regular travel insurance. This can be crucial in case of emergencies or unexpected illnesses while traveling abroad.

Trip Cancellation and Interruption

Extended travel insurance usually offers more extensive coverage for trip cancellations and interruptions, including coverage for pre-existing conditions, natural disasters, or terrorist incidents, which may not be covered by regular travel insurance.

Baggage Loss and Delay

Extended travel insurance typically provides higher reimbursement limits for baggage loss or delay compared to regular travel insurance. This can help travelers replace essential items or clothing in case their luggage is lost or delayed during the trip.

Adventure Sports Coverage

Some extended travel insurance plans offer coverage for adventurous activities such as scuba diving, skiing, or mountain climbing, which might not be covered by regular travel insurance. This can be beneficial for travelers seeking adrenaline-filled experiences during their trip.

Limitations and Exclusions

It’s important to note that extended travel insurance may have limitations and exclusions, such as age restrictions, coverage limits for pre-existing conditions, or specific exclusions for high-risk activities. It’s essential for travelers to carefully review the policy details to understand what is covered and what is not under their extended travel insurance plan.

Benefits of Extended Travel Insurance

Travel insurance is essential for any trip, but extended travel insurance goes above and beyond to provide additional benefits that can greatly benefit travelers during long journeys. These additional perks can offer peace of mind and added security, making extended travel insurance a valuable investment.

Enhanced Medical Coverage

Extended travel insurance often includes higher coverage limits for medical expenses, emergency medical evacuation, and repatriation. This is especially crucial for long trips where the risk of illness or injury is higher. Having enhanced medical coverage ensures that travelers can access quality healthcare without worrying about exorbitant costs.

Trip Interruption and Cancellation Coverage

Extended travel insurance typically offers more comprehensive coverage for trip interruptions and cancellations. This can be extremely beneficial for long trips that may involve multiple destinations and connecting flights. In case of unforeseen events that force travelers to alter their plans, having this coverage can help recoup non-refundable expenses.

Baggage Loss and Delay Protection

Extended travel insurance often includes better coverage for baggage loss, theft, or delay. This can be a lifesaver during long trips when travelers are carrying valuable items or traveling with multiple bags. The added protection ensures that travelers are compensated for any losses or inconveniences caused by baggage mishaps.

Adventure Sports Coverage

For travelers engaging in adventurous activities during their trip, extended travel insurance can provide coverage for a wider range of sports and activities. This is particularly important for long journeys that may involve various adrenaline-pumping experiences. Having the right coverage ensures that travelers can enjoy their activities with peace of mind.

24/7 Assistance Services

Extended travel insurance often includes round-the-clock assistance services such as travel concierge, medical consultations, and emergency assistance. This can be invaluable during long trips when travelers may encounter unexpected situations or emergencies. The convenience of having access to assistance anytime, anywhere adds an extra layer of security.

Cost and Considerations

When it comes to purchasing extended travel insurance, there are several cost factors to consider. The price of the insurance plan can vary depending on the coverage limits, the duration of the trip, the traveler’s age, pre-existing medical conditions, and the destination.

It’s essential to weigh these factors carefully to choose a plan that meets your needs without breaking the bank.

Cost Factors to Consider

- Coverage Limits: The higher the coverage limits, the more expensive the insurance plan will be. Consider your travel activities and the potential risks involved to determine the appropriate coverage amount.

- Trip Duration: Longer trips typically require higher premiums. Make sure to select a plan that aligns with the length of your travels to avoid overpaying for unnecessary coverage.

- Traveler’s Age: Older travelers may face higher insurance costs due to increased health risks. Look for plans that cater to your age group and offer suitable coverage.

- Pre-Existing Medical Conditions: If you have pre-existing medical conditions, you may need to pay more for insurance coverage. Ensure that your plan includes adequate coverage for any existing health issues.

- Destination: Some destinations are considered higher risk due to factors like political instability or healthcare quality. Travel insurance for these locations may come at a higher price.

Choosing the Right Plan

- Assess Your Needs: Consider your travel habits, health status, and risk tolerance to determine the coverage you require.

- Compare Plans: Research and compare different insurance providers to find a plan that offers the best value for your money.

- Read the Fine Print: Pay attention to exclusions, coverage limits, and claim procedures to avoid any surprises during your trip.

- Seek Recommendations: Consult with travel agents, friends, or online reviews to get insights into reputable insurance providers and their offerings.

Considerations for Investing in Extended Travel Insurance

- Emergency Medical Coverage: Extended travel insurance can provide peace of mind by covering unexpected medical expenses abroad.

- Trip Cancellation Protection: Insurance plans can reimburse non-refundable trip expenses in case of unforeseen events like illness, natural disasters, or flight cancellations.

- Personal Belongings Coverage: Protect your belongings against loss, theft, or damage during your travels with the right insurance plan.

- Adventure Activities: If you plan to engage in high-risk activities like skiing or scuba diving, ensure that your insurance covers these pursuits.

Conclusive Thoughts

In conclusion, extended travel insurance is not just a safety net but a companion that ensures your trip is worry-free. With the right plan in place, you can focus on creating lasting memories without the burden of unforeseen circumstances.

Commonly Asked Questions

What is extended travel insurance?

Extended travel insurance provides coverage for longer trips, typically beyond the standard duration of regular travel insurance.

How does extended travel insurance differ from regular travel insurance?

Extended travel insurance offers more comprehensive coverage for extended periods, including additional benefits tailored for longer trips.

What are some typical limitations or exclusions in extended travel insurance coverage?

Some limitations may include specific trip duration requirements or restrictions on high-risk activities not covered by the policy.

How can I choose the right extended travel insurance plan?

Consider factors such as trip duration, destination, activities planned, and personal health needs to select a plan that best suits your requirements.

Is extended travel insurance worth the cost?

For longer trips or those involving higher risks, extended travel insurance can provide valuable peace of mind and financial protection in case of unexpected events.